SAROS Overview – Insider Control and High Risk

SAROS is a high-risk token controlled by insiders. Over 80% of the supply is held by the top 10 wallets, with 63% sitting in one cluster. Most tokens are still locked and set to unlock from 2026, creating long-term sell pressure. The team structure lacks transparency, and the legal terms protect only the project, not users. With little public distribution and no clear accountability, it gives full control to a small group and puts users at serious risk.

ER404i

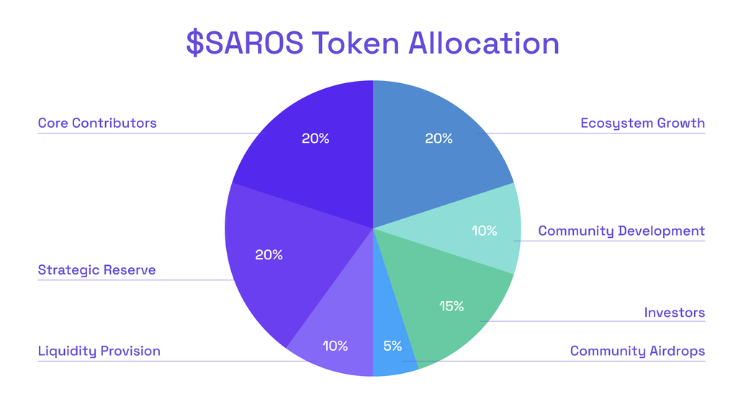

$SAROS Token Allocation – Risk Breakdown

60% allocated to team-controlled segments

Core Contributors (20%)

Ecosystem Growth (20%)

Strategic Reserve (20%)

These categories are typically managed by the team. Combined, they dominate the supply and give centralized control.Only 10% allocated to Liquidity Provision

A small share is reserved for liquidity. Low allocation here can lead to unstable markets or price manipulation if not handled properly.Community Airdrops receive just 5%

Very low distribution to the community. Indicates limited focus on decentralization or fair token access.Investors hold 15%

Moderate allocation to investors. If this isn't locked, early exits could add sell pressure.Community Development gets 10%

Slightly better than airdrops, but still minor. Signals limited grassroots incentive.

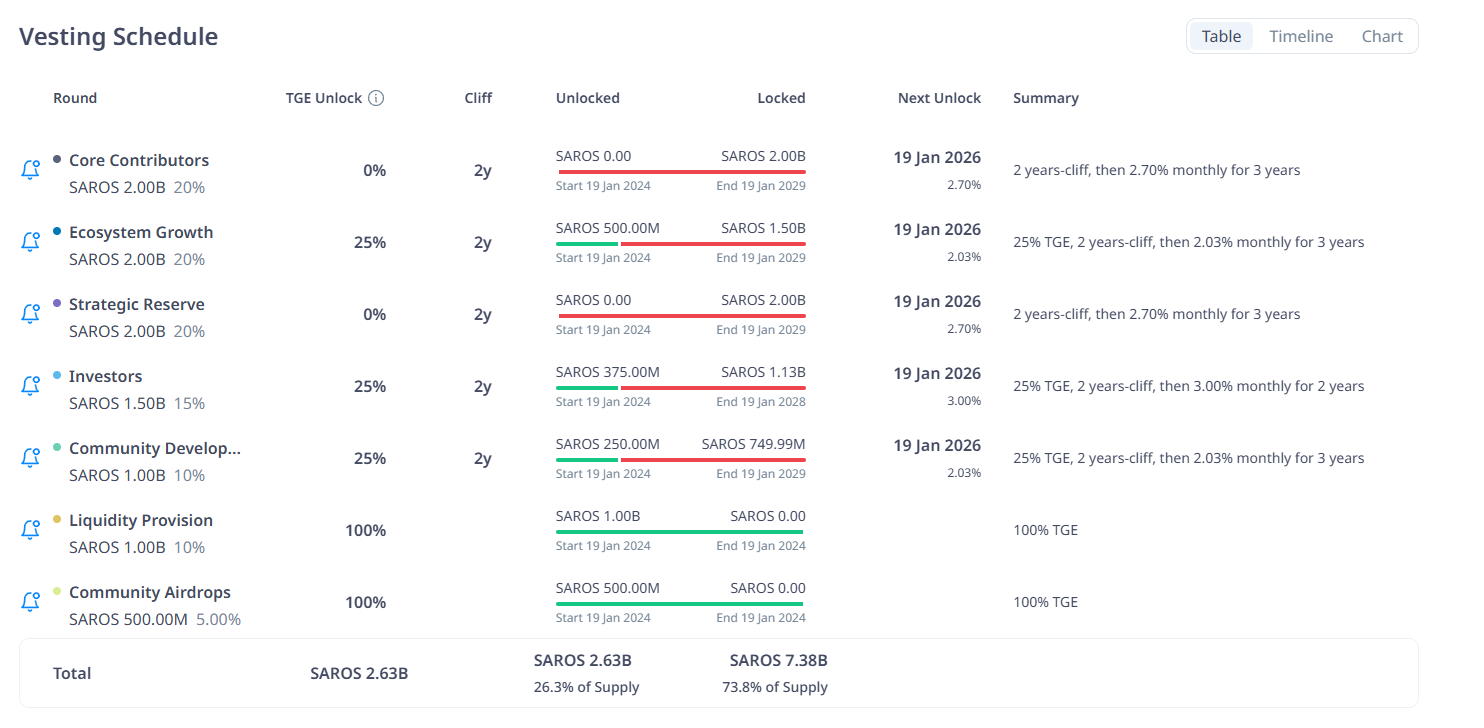

Locked Supply Holds the Real Threat

Over 7.3 billion SAROS tokens remain locked but will start unlocking from 19 January 2026. The largest portions belong to Core Contributors, Strategic Reserve, and Ecosystem Growth, all controlled by insiders. Once the cliff ends, steady monthly unlocks will begin and continue for years. With no visible lock security or multisig, these tokens can be sold freely once unlocked, creating long-term sell pressure and serious dilution risk. The real threat is not what already unlocked, but what’s coming.

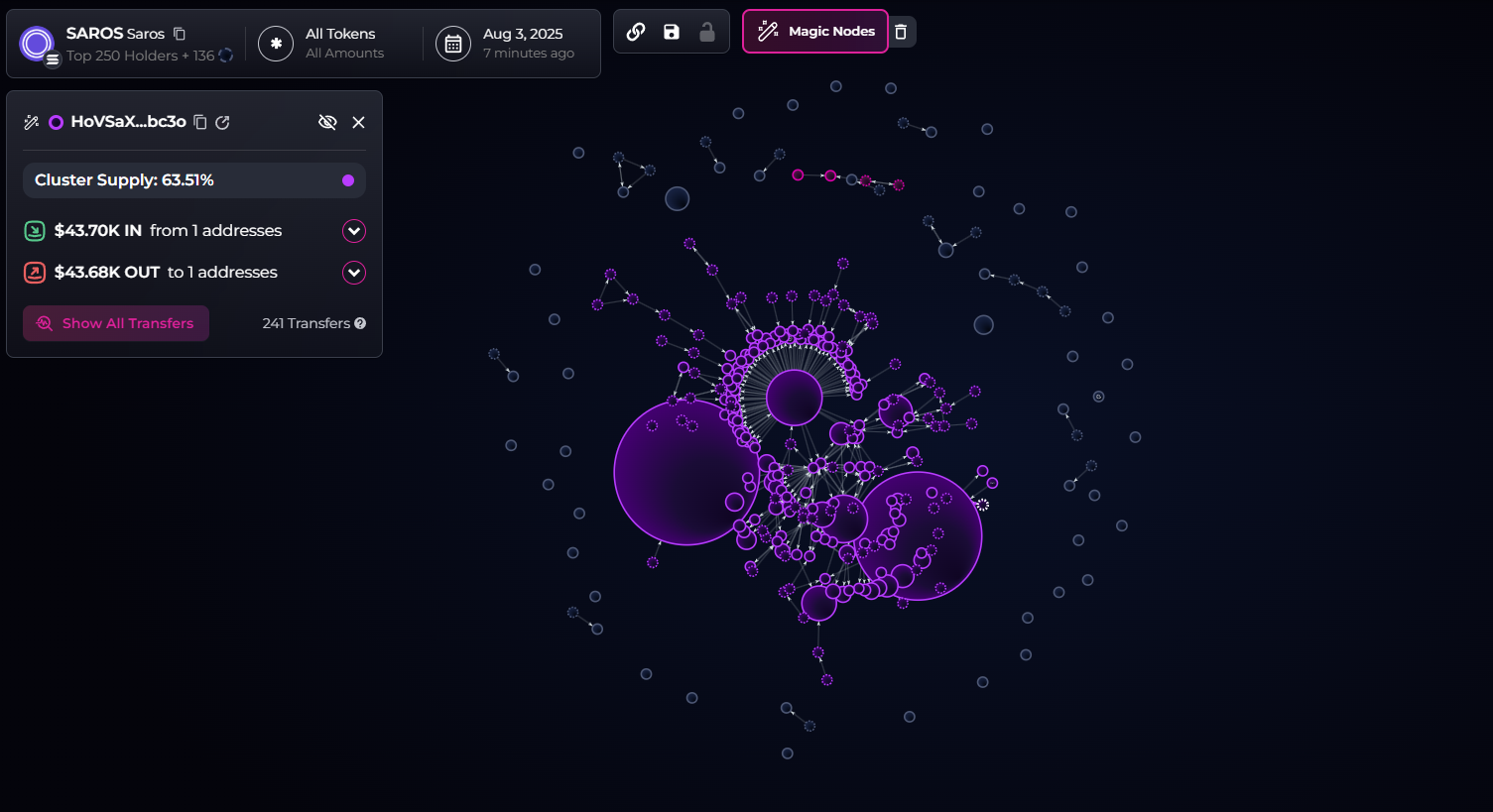

63% in One Cluster — Full Control, Zero Trust

One wallet cluster holds 63.51 percent of the entire SAROS supply. That’s not decentralization, that’s full control. The cluster has over 240 internal transfers, showing it’s active and likely managed by a single entity or closely linked group. There’s no sign of real distribution to outside holders. If these wallets aren’t locked by contract, they can dump at any time without warning. This setup gives total control to insiders and puts the entire market at serious liquidation risk.

Top 10 Wallets Hold 83% of SAROS Supply

The top 10 wallets control 83.23% of the total SAROS supply. This is a serious centralization problem. The top wallet alone holds 24.87%, and the next two hold 19.35% and 15.19%. Together, the top three wallets own nearly 60%, leaving very little in circulation for real users. With this much supply in the hands of a few, the token is fully exposed to manipulation. Any major sell from one of these wallets can instantly crash the price and drain liquidity. This kind of concentration removes trust and increases the risk of coordinated dumps.

Key Legal Risks from SAROS Terms

The SAROS Terms of Service show that the platform takes no responsibility for losses, errors, or failures. Everything is provided as is, meaning they do not guarantee security, accuracy, or availability. If a smart contract fails, if your funds are lost, or if the platform goes offline, SAROS is not liable. They can change or shut down any part of the service at any time without notice, and users have no control or legal protection against that.

The most important part is that SAROS does not owe any duty to protect users. They make it clear that they are not your advisor, not your partner, and not legally responsible for your money. The entire legal structure is built to protect the team, not the users. On top of that, all legal risks and compliance duties are pushed onto the user. If the platform is not legal in your country, it is your problem, not theirs.

This legal setup, combined with the team’s control over most of the token supply, shows a clear imbalance. Users take all the risk while the team keeps all the control. There is no safety net, no user protection, and no accountability from the project side.

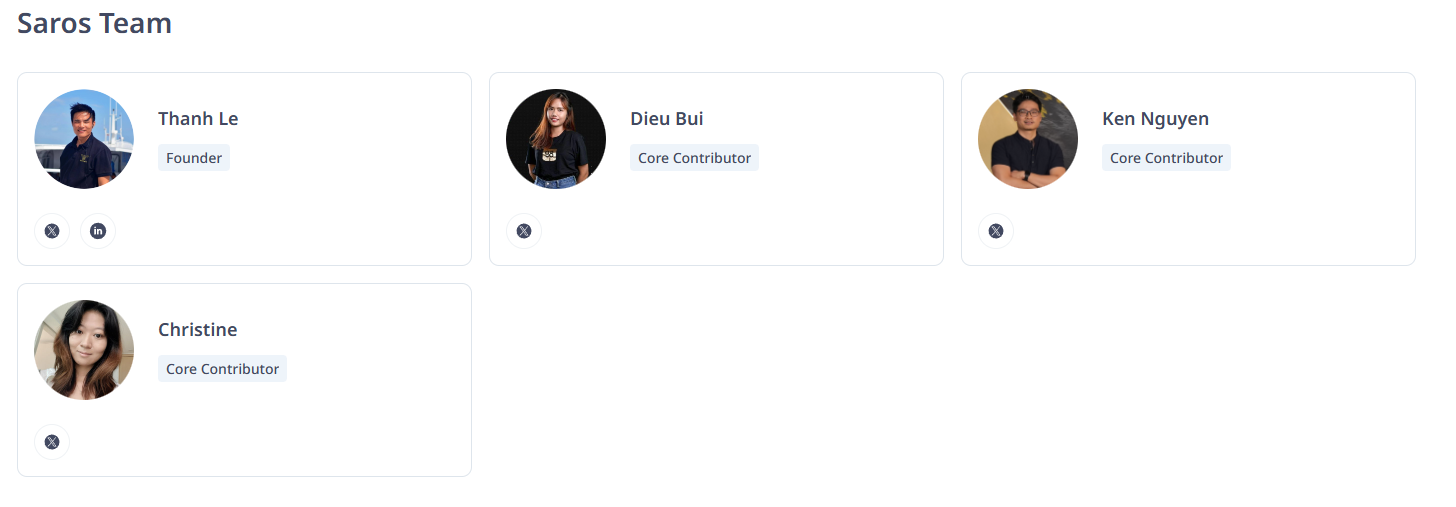

Dev Team Risk

The SAROS team is led by Thanh Le, also known for Coin98, which suffered a long-term price collapse. The rest of the team is listed only as core contributors with no clear roles or public profiles. There is no visible CTO or lead developer.

This vague structure creates major risk. With no public accountability or verified dev team, updates, security, and token control could be managed by a small group without oversight. Combined with heavy insider allocation, this makes the token highly risky for investors.