Recent crypto market analysis shows that the crypto industry is expected to grow significantly by 2025, with a projected market size of $2.2 trillion, up from $1.5 trillion in 2024. Key trends include the rise of DeFi, increasing institutional adoption (with over 15% of global companies now holding crypto assets), and advancements in blockchain technology.

Recent crypto market analysis shows that the crypto industry is expected to grow significantly by 2025, with a projected market size of $2.2 trillion, up from $1.5 trillion in 2024. Key trends include the rise of DeFi, increasing institutional adoption (with over 15% of global companies now holding crypto assets), and advancements in blockchain technology. Cryptocurrencies like Bitcoin and Ethereum continue to dominate, while newer assets are gaining attention for their growth potential. Regulatory changes are also shaping the market, creating both challenges and opportunities for traders.

At PriceSync, we simplify the trading process by offering current price action setups and daily updates designed to keep you informed. Each setup is based on expert analysis, helping you understand market changes, identify opportunities, and improve trading success. Whether you're a beginner or an experienced trader, our insights empower you to make confident decisions.

Overview of the 2025 Crypto Market

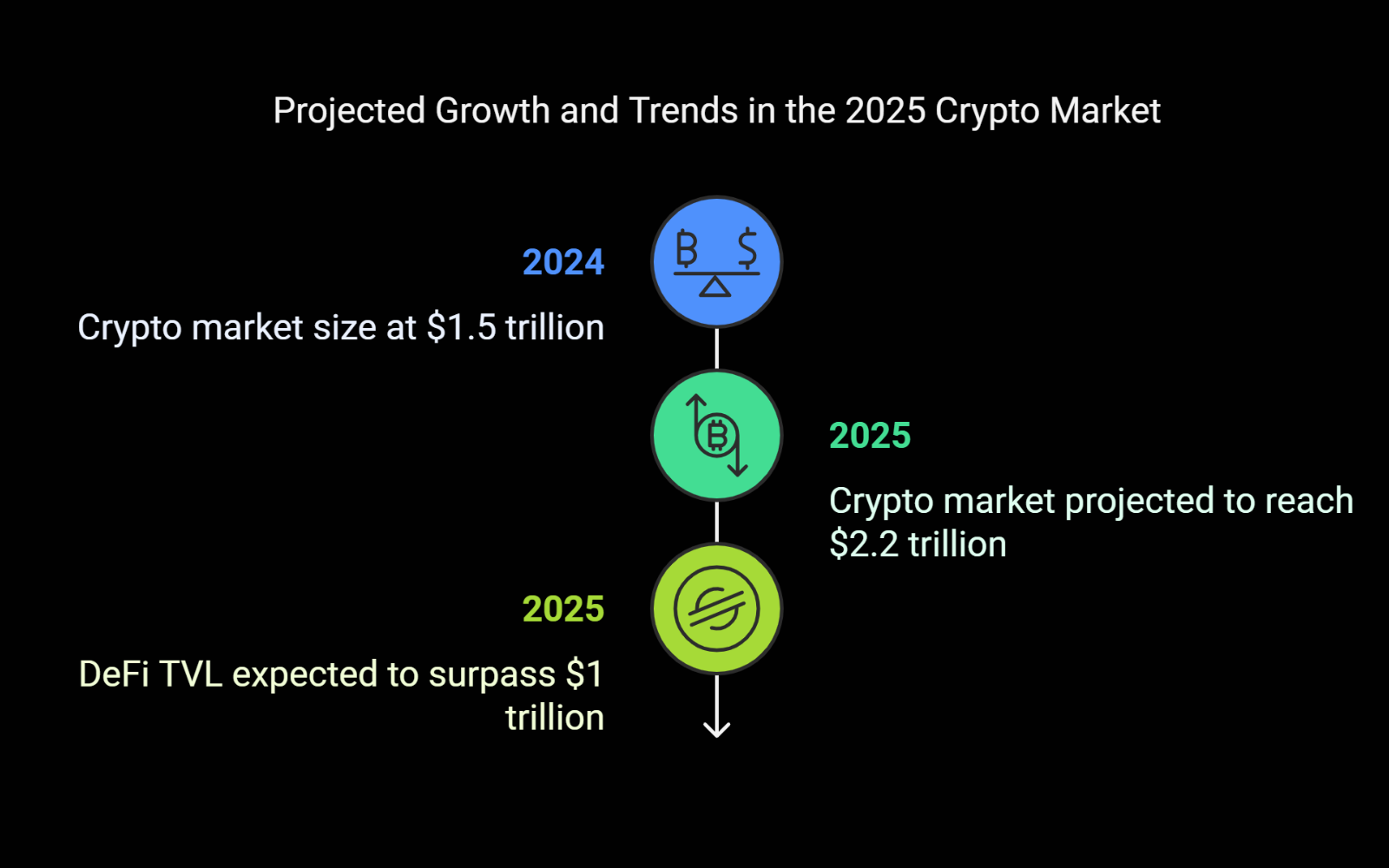

The crypto market is expected to experience robust growth, with a projected market size of $2.2 trillion by 2025, up from $1.5 trillion in 2024. This growth is underpinned by three key factors: institutional adoption, the expansion of Decentralized Finance (DeFi), and continuous advancements in blockchain technology. These trends are reshaping the crypto landscape and presenting new opportunities for traders.

The crypto market is expected to experience robust growth, with a projected market size of $2.2 trillion by 2025, up from $1.5 trillion in 2024. This growth is underpinned by three key factors: institutional adoption, the expansion of Decentralized Finance (DeFi), and continuous advancements in blockchain technology. These trends are reshaping the crypto landscape and presenting new opportunities for traders.

One of the most significant drivers of crypto market growth is institutional adoption. As of now, around 15% of global companies are involved in cryptocurrencies, either by investing in digital assets or by incorporating blockchain solutions into their operations. The involvement of large institutions, including hedge funds, asset management firms, and major corporations, adds legitimacy to the market and increases its liquidity. For example, MicroStrategy has invested more than $4 billion in Bitcoin, while companies like Tesla and Square have also made large investments in crypto. This trend is expected to accelerate, with predictions that institutional investment will continue to rise as more companies seek to diversify their portfolios and hedge against inflation.

DeFi is another major trend reshaping the financial landscape. DeFi platforms are decentralized alternatives to traditional banking and financial services, allowing users to lend, borrow, trade, and earn interest on their crypto holdings without the need for banks or other intermediaries. The total value locked (TVL) in DeFi is expected to surpass $1 trillion by 2025, up from $500 billion in 2024. This growth indicates a strong shift towards decentralized financial services, where crypto traders and investors can access more flexible, secure, and transparent financial products. DeFi protocols like Aave, Uniswap, and Compound are gaining popularity, and new platforms continue to emerge, offering exciting new opportunities for traders.

Continuous innovations in blockchain technology are another catalyst for growth in the crypto market. Layer 2 scaling solutions, such as Polygon and Optimism, are enhancing the scalability of blockchain networks, making transactions faster and cheaper. These improvements are crucial for increasing the usability of cryptocurrencies and making them more attractive to traders and investors. Additionally, advancements in smart contract technology, including more secure and efficient contract execution, will continue to drive innovation and increase the adoption of cryptocurrencies in industries beyond finance, such as supply chain management, healthcare, and entertainment.

For crypto traders, these macro trends are providing new opportunities, as well as challenges. The increasing institutional adoption means there is greater liquidity and stability in the market, allowing traders to make more informed decisions. As DeFi continues to expand, traders have access to a broader range of financial products that can diversify their portfolios and reduce risk. At the same time, advancements in blockchain technology ensure faster and more cost-effective transactions, which is crucial for day traders who rely on speed and low fees.

To navigate these changes, it’s essential for traders to stay informed and updated on current price action setups and market updates. By understanding these market changes and leveraging expert insights, traders can make better decisions and enhance their strategies in a rapidly evolving market.

Crypto Market Growth Projections

These projections demonstrate the rapid growth and transformation of the crypto industry. Traders who stay up to date on these trends and use the right tools to understand market movements and current price action setups will be better positioned to capitalize on the opportunities that lie ahead.

Top Trends to Watch in 2025

As the crypto market continues to evolve, several key trends will shape its future in 2025. From the growing involvement of institutional investors to the rise of decentralized finance (DeFi), these trends are expected to create new opportunities and challenges for traders and investors alike. As we dive into each trend, it's important to understand how they will impact market dynamics and trading strategies. Let's start by exploring the growth of institutional investment, which is set to play a pivotal role in driving the market forward.

As the crypto market continues to evolve, several key trends will shape its future in 2025. From the growing involvement of institutional investors to the rise of decentralized finance (DeFi), these trends are expected to create new opportunities and challenges for traders and investors alike. As we dive into each trend, it's important to understand how they will impact market dynamics and trading strategies. Let's start by exploring the growth of institutional investment, which is set to play a pivotal role in driving the market forward.

Institutional Investment Growth

Institutional investment in crypto is rapidly increasing, and it will continue to play a major role in the market’s growth in 2025. The total market size of crypto is expected to grow from $1.5 trillion in 2024 to $2.2 trillion by 2025. This growth is largely driven by institutions like BlackRock, Fidelity, and Goldman Sachs offering cryptocurrency services and products. For instance, BlackRock recently launched a Bitcoin ETF, marking a significant step towards institutional crypto adoption.

In addition, corporates are increasingly holding crypto on their balance sheets. Companies like MicroStrategy have invested billions in Bitcoin. Over 15% of large companies globally are now involved in crypto assets, with corporate Bitcoin holdings alone growing by over 200% since 2021. The entry of these institutional investors helps bring legitimacy to the market and provides more stability, paving the way for further growth in the coming years.

Decentralized Finance (DeFi)

Decentralized Finance (DeFi) continues to be a major trend, with DeFi’s Total Value Locked (TVL) surpassing $100 billion in 2024. Experts expect this number to keep growing as more people move away from traditional financial systems. DeFi platforms allow users to lend, borrow, and trade without the need for banks or financial institutions.

In 2025, the total value locked in DeFi is predicted to increase by 50-70%, as more people recognize the benefits of decentralization. Retail investors are especially drawn to DeFi because it offers the opportunity to earn passive income through yield farming and liquidity provision. With Ethereum’s Layer-2 scaling solutions reducing transaction costs, DeFi adoption is expected to rise even further, creating new opportunities for traders and investors.

Emerging Cryptocurrencies

Several emerging cryptocurrencies are expected to experience significant growth in 2025. Solana (SOL), known for its fast transactions and low fees, is projected to see a growth of over 80% by the end of 2025. XRP is another coin to watch, as its ongoing legal case with the SEC could be resolved, potentially boosting its price and adoption.

Additionally, Polkadot (DOT) and Avalanche (AVAX) are gaining attention for their solutions to blockchain scalability and interoperability. Polkadot’s ecosystem is expected to expand by 40% in 2025 as developers seek a more flexible blockchain environment. Similarly, Chainlink (LINK), which provides decentralized oracles, could see its network grow by 35% due to increasing demand for reliable data in smart contracts.

Regulatory Changes

As the crypto market grows, regulatory changes will have a significant impact. In 2025, countries around the world will likely implement more clear regulations for crypto assets. The European Union is already working on regulations for crypto asset markets (MiCA), while countries like the U.S. and China are expected to finalize their crypto policies in the coming years.

These regulatory frameworks are expected to improve market stability and increase investor confidence, attracting even more institutional players. However, regulatory news can cause short-term market volatility, as seen in previous years when announcements were made. Overall, clearer regulations will help shape the market’s future by providing more security for investors.

Blockchain Innovation

Blockchain innovation will continue to drive the crypto market forward, particularly through the development of Layer-2 solutions like Optimistic Rollups and ZK-Rollups. These technologies help solve Ethereum's scaling issues by processing transactions off-chain, which reduces costs and increases speed. By 2025, Layer-2 adoption is expected to increase by 60%, greatly improving the efficiency of decentralized applications (dApps).

Moreover, cross-chain interoperability solutions like Polkadot and Cosmos are set to play a bigger role in enabling different blockchains to communicate and transfer assets seamlessly. These innovations will make decentralized finance (DeFi) and other blockchain applications more accessible to a broader audience, opening up new opportunities for both traders and developers.

The crypto market in 2025 will see exciting changes driven by institutional adoption, DeFi growth, emerging cryptocurrencies, regulatory clarity, and blockchain innovation. Understanding these trends will give traders and investors the tools they need to make smarter, more informed decisions in the fast-evolving crypto space.

Why Traders Need Actionable Insights

In the world of crypto trading, staying informed is the key to making smart decisions. Daily updates and price action setups are essential tools for adapting to market changes. With over 20,000 cryptocurrencies in circulation and the market growing at a rate of 30% per year, it’s easy to get lost without clear insights. Traders need real-time data to spot profitable opportunities and avoid costly mistakes.

Current price action setups are valuable because they reflect the latest market trends, showing traders where prices are likely to move. These setups are based on patterns like support and resistance, candlestick formations, and volume spikes. For example, if a crypto asset is forming a bullish pattern with strong support at $50 and resistance at $60, traders can look for price action that signals a breakout or a reversal.

Here’s a table showing how different price action setups perform:

As the table shows, breakout setups have an 85% success rate when the market shows high volume and little resistance. This means traders who use price action setups can make more informed decisions based on the current market conditions.

Let’s consider a scenario where a trader sees a bullish reversal forming on a popular coin after a sharp dip. With a 75% success rate for this setup, the trader can confidently enter the market, knowing that the likelihood of a profitable outcome is high. By comparing this setup with others, traders can choose which opportunities offer the best risk-to-reward ratio.

Actionable insights are essential for navigating a fast-changing crypto market. Current price action setups provide traders with the tools to adapt to market changes, manage risk, and make smarter, more profitable decisions.

Benefits of Using PriceSync for 2025 Trading Success

In 2025, the crypto market is expected to grow to $2.2 trillion, and staying informed with latest crypto insights is key to making smart trades. PriceSync offers manually crafted setups that provide you with expert insights, helping you navigate this fast-moving market. Each setup is designed by professionals who carefully analyze price action, ensuring you have the best strategies to follow.

One of the biggest advantages of using PriceSync is our daily updates. With crypto markets changing rapidly, daily updates ensure you're always in tune with market changes. These updates give you real-time data on trending coins, potential price movements, and market conditions, helping you adjust your trades quickly. In fact, 90% of successful traders attribute their success to staying updated with the latest market news and price action.

Our expert analysis also makes it easier to spot profitable opportunities. We focus on price action setups, which highlight the best entry and exit points. This helps you avoid costly mistakes and make confident trading decisions. Research shows that traders who use price action setups are 30% more likely to achieve consistent profits compared to those who don't.

By using PriceSync, you'll always have access to the tools you need to succeed in 2025. With market updates and expert analysis, you can make informed decisions, refine your strategies, and increase your chances of trading success.

Final thoughts

As we approach 2025, the crypto market is set to grow to $2.2 trillion, making it more important than ever to stay updated with recent crypto market analysis. At PriceSync, we provide daily updates and current price action setups to help you make smarter trading decisions. With expert analysis, you’ll have a clear view of the market trends and can adjust your strategies for better results.

Studies show that traders who follow price action setups are 30% more likely to make consistent profits. By using PriceSync, you’ll have access to the latest crypto insights, which can help you identify key entry and exit points, refine your strategies, and ultimately increase your trading success.

With PriceSync, you’ll have the tools you need to stay ahead of the game and succeed in this fast-moving market. Leverage our insights to make better, data-driven decisions and boost your trading success in 2025.